Budgeting for the year is the last thing most of us *want* to do, but it's probably the most important in order to achieve your life goals.

"Whether you want to pay off debt or build wealth, the budget’s entire job is to increase your net worth," says Erin Skye Kelly, author of Get the Hell Out of Debt: The Proven 3-Phase Method That Will Radically Shift Your Relationship to Money. "A budget says that you matter, and your dreams matter — and when we take care of ourselves first financially, we are in a better position to help others."

Well put. Here are some of the most-googled questions about debt, plus seven ways to get out of debt in 2023 and starting living your best life.

How To Pay Off Credit Card Debt?

Come up with a payment strategy that works best for you and your current financial situation. Check out what the plans look like for your credit card, and implement that number into your budget. If you're really serious about debt, it will mean that you have to cut back on your spending money, but think about how much extra cash you'll be saving once you're debt-free!

What Is A Debt Snowball?

A debt snowball refers to the idea of paying off all of your smallest debts as quickly as possible. Let's say you have four debts at $10, $20, $30, and $40 a month. After you've paid off the $10, suddenly that's $10 you didn't have before that you can put towards the $20 debt, and so on until all your debt is gone.

This method helps you pay off your debt faster, and you might be able to even increase your monthly installments to shorten your payment plan (which will then decrease the amount of interest you pay in the long run).

How To Get Out Of Debt?

When it comes to getting out of debt, the method that works best for you might be different than what works best for someone else. There are a variety of factors, from financial situation to income to dependents, but no matter what your life look like right now, here are some ways to help you conquer your debt.

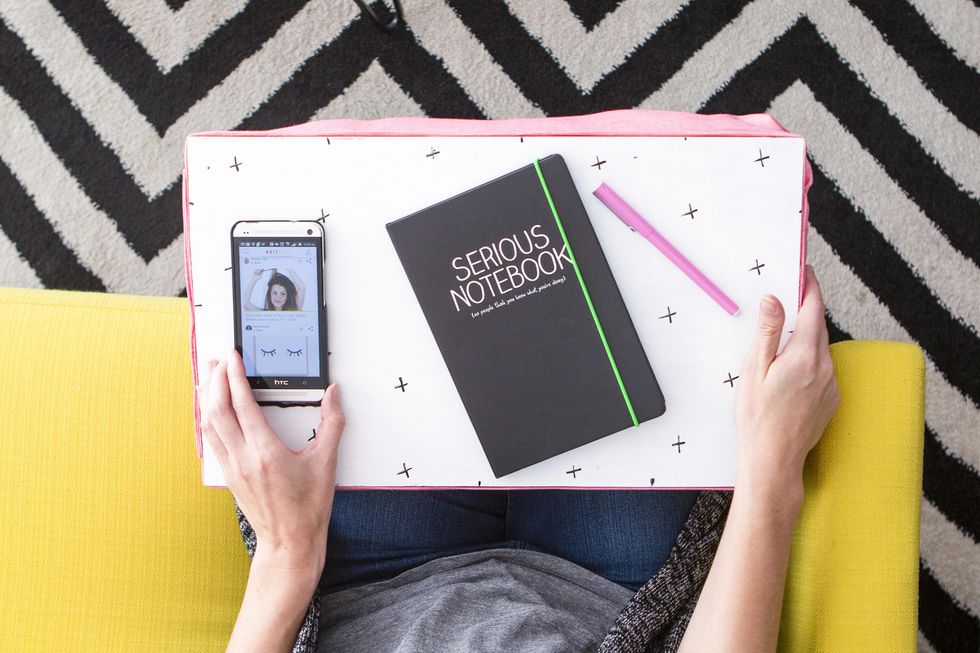

Create An LBD (Little Budget Library)

A little budget diary is a way to take stock of all your monthly and annual expenses, such as magazine and newsletter subscriptions, streaming services, and groceries — and write them all down in your LBD, notes Brit + Co's Money School instructor Nicole Lapin.

"You'll reference this all year — weekly is best — so you'll want to start off on the right foot with an easy-to-reference LBD. Don't make it hard. It's an easy task that will help you get organized quickly," she says.

Be Realistic About Your Finances

"Do not be aspirational with your numbers," says Skye Kelly. "Pay attention to how you ACTUALLY live and how you ACTUALLY spend and work from there."

Track your expenses for a month to create an accurate budget or look at your paycheck and follow the 50-20-30 rule. These are the percentages you should spend on essentials, your future, and your lifestyle with the goal to live within your means and eventually start saving and investing.

Check out Brit + Co's Teach Me Something New podcast with finance pro Tonya Rapley for breaking out of the paycheck-to-paycheck cycle.

Set Your Sights On Big Goals

Whether it's that dream bucket-list trip or a buying your first home, think about what your long-term goals are and think big when planning a budget.

"When we are committed to a massive financial goal (retiring early and traveling the world with your life partner) suddenly the decision between roses or calla lilies as a wedding bouquet seem meaningless, and we are more inclined to find ways to spend less so we can meet our long-term financial goals," says Skye Kelly. She adds: "Create a budget for the milestone, stay resourceful and use points, seasonal sales, and help or hand-me-downs where you can."

Check out Brit + Co's Teach Me Something New podcast with The Points Guy for credit card tips and travel hacks.

Spring Clean Your Finances

Take a moment to spring clean your expenses. Dedicate a weekend afternoon and delete unused subscriptions, close and consolidate accounts, check in with your savings and retirement plans if you have to make sure they're working for you, reduce auto-renewals, and unload credit card debt by consolidating them into a single low-interest personal loan. It will feel as good, if not better, than spring cleaning your house, plus think about the money you'll have saved in that afternoon.

Find Your Side Hustle

Beyond just reducing your expenses, look at ways you can increase your income so you can start saving and investing to grow your wealth.

"Increasing income might look like side jobs, part-time employment, creating an income stream, selling clutter around the home, or creating a product or service that meets the demands of the marketplace," says Skye Kelly.

Look at selling clothes on resale sites, having a garage sale come spring, selling books online, starting an Etsy shop if you have a creative interest... anything that will add some extra cash in your pocket each month.

Don't Strive For Perfection

"Because budgets are rooted in math, we tend to see everything as right or wrong, which *shudder* brings up a lot of grade-school math class shame for many of us," says Skye Kelly. "If you plan your budget at the beginning of the month and at the end of the month it was only 80% accurate, you are likely killin’ it financially. I’ve asked hundreds of financial experts over the years ‘how many times did you get the budget exactly right?’ and every single answer has been ‘zero times.’"

Avoid Making Money Decisions During Hard Times

Mental wellness plays a big role in how we view our expenses and often we can make decisions in order to make us feel better (retail therapy, anyone?) instead of making healthy long-term financial decisions. "Having a line item in the budget for guilt-free spending is critical if you can afford it," says Skye Kelly. "This guilt-free spending money is there for times you want to splurge even though you might not be able to justify it."

Skye Kelly says it's best to avoid major financial decisions if you can for at least 6 months:

- After a significant death or when you are grieving

- While you or a loved one are experiencing a critical illness or at the onset of a new disability

- After a major breakup or divorce

- When you’ve entered into a new romantic relationship

- If you’ve been diagnosed with or suspect you have a mental illness and are awaiting treatment

"During these times we are highly likely to make emotional or impulsive decisions. Instead, making a note in your calendar for September 2022 that says 'do you still want to move to Guam in typhoon season?' to give yourself time to regulate some of the higher intensity emotions that might be driving the urge to spend."

Curious about crypto? Check out Brit + Co's Teach Me Something New podcast with finance pro Nicole Lapin for a primer on how to make your first crypto investment.

How are you getting out of debt in 2023? Let us know on Twitter and check out our email newsletter for the latest tips on saving money.

This post has been updated.

0 Commentaires